.png) Jaswant Kaur

Jaswant Kaur

After around five years of demonetisation, one of the worst periods we had seen in recent years, the government has come up with a monetisation plan. Some may think that the government wants the public to have some money in their hands! Or, is it thinking of bringing the scrapped notes back into circulation?

That’s the exact opposite of the word demonetisation in common parlance. Isn’t it? Well, if wishes were horses, even beggars would ride. Jokes apart, the government wants to generate money from its existing assets, which are under-utilised.

In layman’s language, it wants to rent out its assets to prospective lessees to earn money. Just like anyone, who owns an unused property would like to do, to have extra revenue. In simple language, the plan looks perfect. After all, this is one way of meeting the immediate cash requirements, especially at a time when the Indian economy is going through a rough patch and fiscal deficit is at an all-time high.

The concept is not a new one. It has been there ever since the securitisation and reconstruction of financial assets and enforcement of security interest act (Sarfaresi), 2002 was promulgated. The Act helped the banks in recovering their money easily when a particular account becomes a non-performing asset (NPA) by initiating sale of securities that have been pledged to secure the loan.

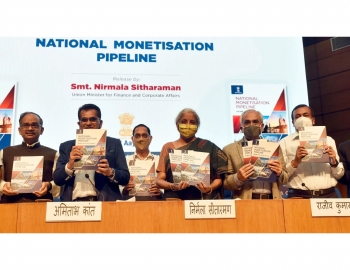

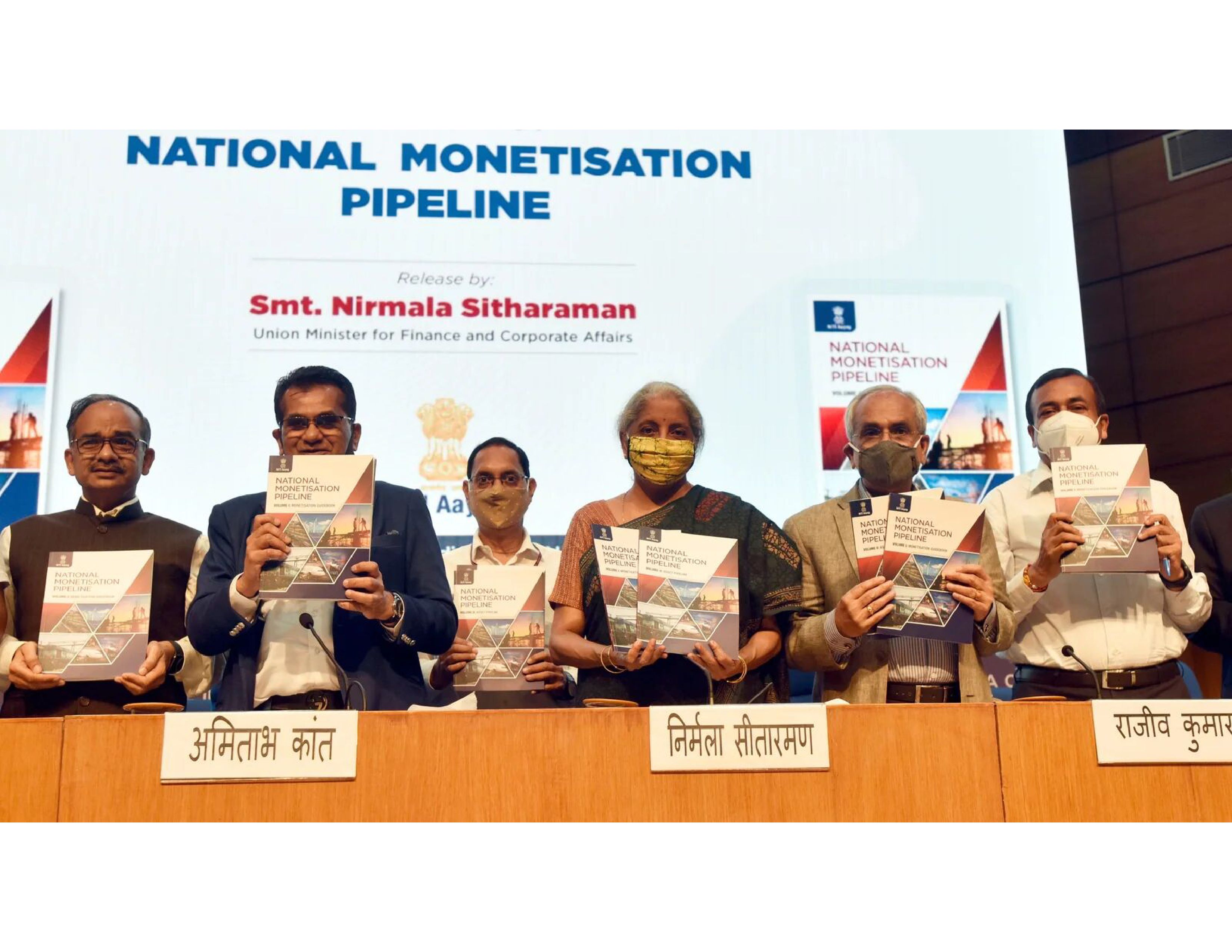

Last week, the finance minister went a step ahead and launched the national monetisation plan (NMP) to make use of distressed assets or brownfield assets. A majority of these assets are in crucial sectors like road, railways, airports, mines and power.

The minister, in close coordination with the NITI Ayog, has announced a plan wherein private investors shall be roped in for not only taking these assets on lease but also for their upkeep, maintenance and capital investment. The money raised from the NMP will be used to fund the national infrastructure pipeline (NIP) announced by the Prime Minister in his Independence Day speech of 2019.

Technically, one pipeline will pave the way to the other one. Now, does it mean that the government had no plan for the NIP all these years? And the announcements made by the PM had no ground? In fact, similar announcements were made consecutively for the last two years. Some may say that Covid-19 played havoc, putting a dead-end to the NIP.

Be that as it may, the government has set an ambitious target for itself. It wants to raise Rs. 5.6 lakh crore over the next four years through structured leasing and securitisation transactions, which will fund the NIP partially. The government expects to earn a revenue of Rs. 88,000 crore in the current fiscal besides Rs. 1.75 lakh crore from the sale of firms like the BPCL and Air India.

It is a different matter that the government could not sell these companies despite its best efforts. Now the question is, if private players are not ready to buy assets, will they be really interested in taking them on rent?

An outright answer to this might be that private players might be interested in assets that would fetch them a return more than what they have to pay the government. In other words, what may be considered profitable to the government might not look equally rosy to the private players. The NITI Ayog report has set forth the revenue it intends to earn from these assets. It might not be practically achievable as a single formula usually does not fit all.

The plan intends to give these assets on lease for, say, 25 to 50 years but taking away future cash flows in the first few years. Assuming that an asset has a value of, say, Rs 1 lac crore today, the government wishes to take the entire rental value in, say, a year or so. By the time the lease period is over, these assets may have been fully depreciated to zero value. Technically, the government might say it is holding the ownership rights on paper, generating as much revenue as possible in the very beginning but left with no other option to write off the asset in its books after 25 or 50 years!

So, what kind of terms and conditions might be there between the private players and the government? To avoid a situation like this, the government would be expecting the private players to invest in the assets on a continuous basis. But would it seem feasible? Even if the private party invests in the asset, it would certainly want revenue, which will be passed on to the end consumer.

In other words, the assets which the government created with public money collected through various taxes, will be indirectly sold to private players, leaving them with no other option but to pass on the cost to the end consumer, who happens to be the same taxpayer. Now, imagine, you and me paying for upkeep of the same asset which was created from the taxes we paid to the government long back.

Will it not be injustice to the common man? As of now, there is no clarity on the conditions that the government might have while entering into deals with the private entities. Not only this, putting its assets on lease or sale in bulk may promote monopoly of a few corporate houses or entities that have the wherewithal of acquiring a major chunk of these assets. Either way, the government is either aiming at deemed privatisation or taxing the common man for doing its bit for the country.

One can recall how the government had leased out six airports under public-private partnership in 2019 for 50 years. The deal went in favour of Adani group, who took charge of all the six airports. This reiterates the fact that the NMP may promote monopoly and restrict competition in these sectors.

Another question is whether the government will be able to earn a revenue of Rs. 5.6 lakh crore from its prestigious monetisation pipeline. If one speaks about airports, the estimated revenue from the deal was much higher than the amount that the government actually earned in one year.

Similarly, in case of roads, the government has taken a benchmark of earning Rs. 6 crore per km in view of the revenue it generated from awarded toll rights of Mumbai-Pune expressway. The plan is to monetise 26,700 kms till March 2025 at the same rate.

However, a newspaper report shows that, on an average, toll revenue ranges from Rs. 6 lac per km to Rs. 3.8 crore per km depending upon the traffic and number of people using that road. Simply put, the estimations that the government has put across may not be achievable.

If the revenue estimates are incorrect, one can imagine the kind of money the government will be able to channelise into the NIP. Not only this, the government has not set up its legal machinery in place for handling such cases. Entering into long-term contracts might entail strict enforcement and also long-drawn legal battles in case of non-compliance.

Our judicial machinery and infrastructure are one of the weakest in the world. Globally, we rank at 163 among 190 countries in terms of contract enforcement index. It speaks volumes about the efficiency of our law-enforcement agencies.

Anything that requires public-private partnership certainly needs a fair and transparent system. Incidentally, policy implementation has been our Achilles heel. Above all, the government did not take the opposition into confidence while devising this scheme. Nor did it initiate any public consultation.

A long-term policy like NMP may lose its traction in case it does not suit the interest of people/political parties, who may form future governments. Engaging other political leaders while formulating such policies mitigate such risks at the very beginning. In such a scenario, the NMP might not gain interest from private players and investors.

The claim that the NMP might boost the economy and create employment opportunities look baseless. If the revenue estimates are not correct, we will have little money for further rotation. In fact, people may lose jobs as private organisations will certainly have different plans. To sum up, the NMP accompanied by the NIP seems to be a distant dream in the absence of a clear-cut plan.

(The writer, a company secretary, can be reached at jassi.rai@gmail.com)